By Gary Austin, Payer/Provider Interoperability Lead

.jpg?width=325&name=blank-billboard-inside-train-station-picture-id1187658601%20(1).jpg) *CMS/ONC Rules Timeline was updated on 11/16/2020 to reflect changes to the deadlines.

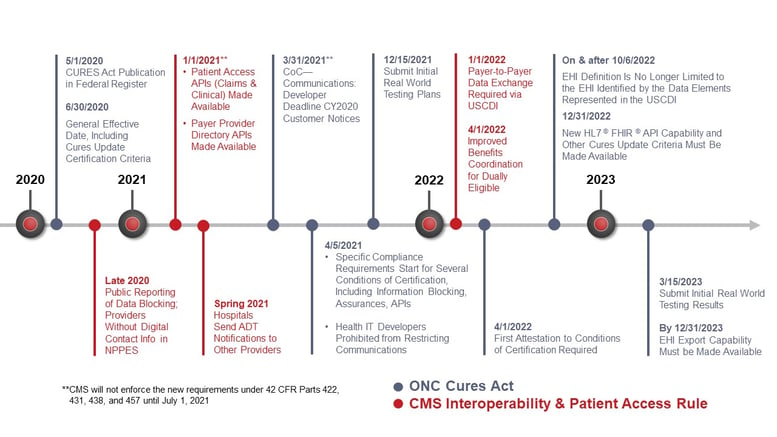

*CMS/ONC Rules Timeline was updated on 11/16/2020 to reflect changes to the deadlines.

Changes in regulations, technological innovation and the healthcare landscape are propelling application programming interfaces (APIs) forward as the preferred way to exchange both patient clinical and administrative data. In fact, APIs are rapidly beginning to replace or augment legacy electronic data interchange (EDI) transactions in healthcare. This changeover gives organizations who are parties to value-based care (VBC) contracts the opportunity to re-engineer underlying administrative and clinical processes, such as electronic prior authorization (ePA). They can be enabled to create competitive advantage and significantly reduce costs—not to mention improve the member’s/patient’s experience.

EDI vs API. So, what’s the difference between EDI and APIs? Let’s level set.

- EDI. EDI is the historical way for healthcare organizations to securely collect and share claims and patient data. EDI has several drawbacks. EDI is based on often immutable standards which take years to update or replace. It is not nimble in adapting to changing technologies, shifting business needs, incremental data requirements and regulatory mandates.

- APIs. APIs are a key part of the digital transformation of healthcare. An API serves as a software interface between two endpoints (such as a mobile app or electronic health record and a payer’s back-office system) to enable information sharing in real-time. An API can be configured to send or retrieve data that can update an individual’s record or provide aggregated data that can be used to create reports for diagnosis and treatment. APIs can be implemented quickly and inexpensively once the API technical framework is in place. Some legacy EDI systems are not fully interoperable with API technology and may require retrofitting or bolt-on technology.

Adoption accelerators. The accelerated adoption of APIs for patient data exchange is coming sooner rather than later, under provisions of the 21st Century Cures Act. Payers and providers must comply. Two implementing regulations (click here to read more about them) mandate quick creation and adoption of APIs to enable data sharing among providers, patients and payers. As required by the new rules, APIs will be based on HL7’s FHIR (Fast and Interoperable Healthcare Resource) standard, version 4, which is web-based. Many payer systems have yet to convert to the new standard.

The new rules give patients access to their health information and move the healthcare system toward greater interoperability. As shown on the timeline below, payers have short deadlines to implement APIs to support patient access to their own data, provider directories and payer-to-payer data exchange.

CMS/ONC Rules Timeline

The API Opportunity

As APIs rapidly become part of the healthcare scene, payers and other entities that support VBC contracts are faced with the prospect of integrating them with their current EDI system or replacing certain transactions altogether. Business process change will be paramount.

An example is prior authorization, which is one of the most complex and costly healthcare transactions. Despite many advances in standards and technology, it remains a largely manual process. According to the CAQH’s 2019 Index, the industry savings opportunity with electronic prior authorization (ePA) is $10 per authorization or $454 million in Potential Annual Savings for the Medical Industry.

The good news is that a lot of the frustration and churning involved in completing PA transactions can be improved today, from elimination of manual review processes and reduction in claim kickbacks to providers for missing or incomplete information. The potential benefits of fully automating the PA process are significant:

- Improved Patient Outcomes: More than nine in 10 physicians (92 percent) say that prior authorizations programs have a negative impact on patient clinical outcomes, according to an AMA physician survey. In another survey of insured Americans through the Doctor-Patient Rights Project (2017), respondents whose payer denied coverage of a prescribed treatment reported their median wait time to seek approval and be denied was greater than one month. Almost a third (28%) shared that the approval process took three months or longer. While waiting for a payer to consider an authorization request, another third (29%) experienced a worsening of their condition due to delayed treatment. (Source: eHealth Initiative)

- Improved medication adherence: The manual PA process is inefficient and time-consuming and leads to the patient abandoning the prescription 37 percent of the time. Turnaround times for ePA determinations can be on average 35 percent shorter as reported by a major pharmacy benefit manager, which has been shown to increase medication adherence. (Source: 2019 ePA Adoption Scorecard)

- Reduced Administrative Costs: Manual (phone/fax) prior authorization is the most costly, time-consuming administrative transaction for providers. On average, providers spend almost $11 per transaction to conduct a prior authorization manually and payers must often reject claims for missing or incomplete information. According to CoverMyMeds, approximately 11 percent of prescription claims are rejected at the pharmacy, and, on average, 66 percent of those prescriptions require PA. CAQH reported the improved efficiencies of ePA can directly save plans over $3 per medical prior authorization or an estimated $99 million annually. Another analysis points out that use of ePA could create significant savings by reducing plans’ call center volume (by as much as 22% in some cases).

How APIs Will Benefit Payers

Reengineering administrative processes to facilitate data exchange through APIs can benefit payers in several ways. For example:

- Improved member stickiness. The widespread use of the internet, social media and on-line retail changed consumer behavior and expectations. Consumers demand a new, high level of customer service with the vendor, whether it is an on-line retailer, an airline, or their health plan. As a result, consumers expect a seamless, hassle-free experience. The incoming ability to shop healthcare services puts providers in new competitive modes, in which patient recruitment and retention will be influenced by easy access to their data and how they are exchanged.

- Improved provider satisfaction. Less hassle and happier patients translate into improved provider satisfaction and morale. Not only does this have implications for retention, but it also is a metric on which payers may be judged.

- Improved population health. Population health is taking on improved importance on the post-COVID-19 world to identify populations at risk for the virus and chronic illnesses as well as more cost-effective ways to manage those conditions. Using APIs to share patient data will be key. A 360-degree view of the patient can create unparalleled insights into the patient’s condition and gaps in care.

- Compliance with regulatory requirements. The use of APIs by health plans to exchange patient data is now a government mandate. While compliance penalties have been temporarily suspended due to the COVID-19 crisis, they will be back in full force at some point. In the meantime, competitors will be moving full steam ahead on not only meeting rules compliance, but also leveraging the new capabilities for marketplace leadership.

- Steerage. As price and quality performance data become more transparent, those VBCs that can provide data to members/patients and steer them to quality- and price-appropriate care delivery are able to significantly alter their marketplaces and gain competitive advantage.

For payers to capitalize on APIs, it is critical for them to identify underlying technology gaps related to patients’ data access, patient-to-provider/or caregiver data sharing and payer-payer data transfer. Many VBCs do not have the underlying technology—or revamped administrative processes—in place to accomplish the lift needed for each of these. If they don’t start building this capacity as soon as possible, their competitors will leave them in the dust.

Point-of-Care Partners is uniquely positioned to guide your organization in the transition to the growing, patient-facing health IT economy. Want to know more about APIs and VBC? Reach out to me at Gary “Lumpy” Austin (gary.austin@pocp.com).